As we settle into 2025, it’s the perfect time to focus on planning financials for the year ahead and reflecting on the strong connection between financial stability and mental well-being. While many prioritise health and career resolutions at the start of the year, financial planning often takes a back seat. Yet, it’s one of the most impactful steps you can take for a balanced and secure future.

The Link Between Financial Stability and Mental Health

Money remains one of the most significant stressors in modern life. According to recent studies, financial stress is a leading cause of anxiety, depression, and strained relationships. On the flip side, having a clear financial plan can reduce uncertainty, enhance feelings of security, and empower individuals to make informed decisions.

By taking control of your finances, you create a stable foundation that supports other aspects of your well-being, including physical health, career growth, and personal relationships.

Step-by-Step Guide to Financial Planning for Stability and Wellness

- Assess Your Current Financial Health

Start by evaluating your current financial situation. List all your income sources, expenses, debts, and savings. This clarity will help identify patterns, unnecessary expenditures, and areas for improvement. - Set SMART Goals

Financial goals should be Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of a vague goal like “save money,” aim for “save $5,000 by December for a family vacation.” - Create a Budget That Works for You

A well-structured budget is the backbone of financial planning. Allocate funds for necessities, savings, investments, and discretionary spending. Don’t forget to include an emergency fund to cover unexpected expenses. - Automate and Simplify

Use technology to automate bill payments and savings. This reduces the cognitive load of remembering due dates and ensures consistency in meeting financial obligations. - Plan for Long-Term Security

Consider retirement plans, insurance policies, and investment opportunities. Long-term planning not only secures your future but also provides peace of mind in the present. - Address Financial Anxiety

If money worries persist, seek support. Talking to a financial coach or therapist can provide valuable insights and coping strategies. Platforms like SupportRoom integrate mental health support with financial guidance, addressing the emotional side of money management.

Why Planning Financials Early Matters

- Improved Decision-Making: A clear plan allows you to allocate resources effectively, avoiding impulsive spending or debt traps.

- Stress Reduction: Financial clarity reduces uncertainty, one of the main triggers of stress and anxiety.

- Increased Resilience: A robust financial plan can help you navigate life’s uncertainties, from job changes to unexpected medical expenses.

- Goal Achievement: Aligning your finances with personal and professional goals creates a sense of purpose and accomplishment.

Building Financial Wellness with SupportRoom

At SupportRoom, we recognise the intricate relationship between financial health and mental well-being. Our platform offers access to professional therapists and coaches who can guide employees through creating a financial plan tailored to their needs and aspirations. By partnering with organizations, we ensure employees receive comprehensive support that combines financial expertise with mental health resources. This not only helps reduce stress but also contributes to a more resilient and engaged workforce.

Planning your financials for the upcoming year is more than just a practical exercise—it’s an investment in your mental health and overall stability. By taking proactive steps today, you set the stage for a more secure, balanced, and fulfilling future.

Our partnerships ensure that employees have access to the resources and support they need to thrive financially and mentally. Ready to make financial wellness part of your strategy? Let’s build a better future together.

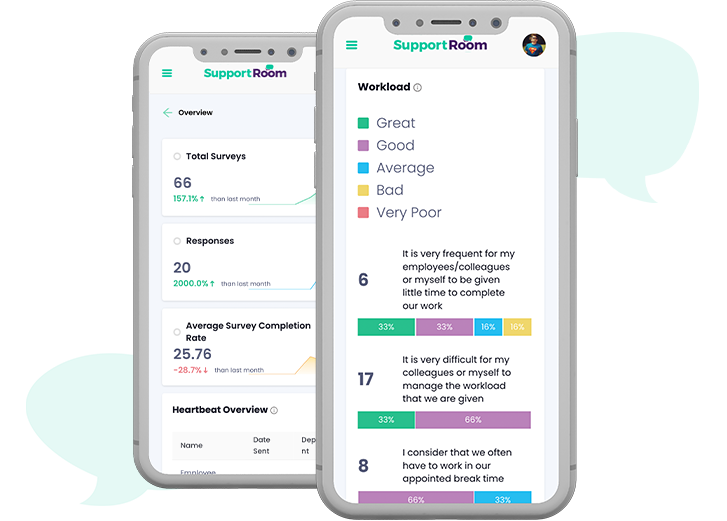

Gain FREE access to Heartbeat

Get a free Heartbeat Survey.

Let us uncover the true state of your team’s wellbeing with a free mental health survey for your entire organisation.

Gain valuable insights to see how you can better support your team’s mental health and performance.

No pitch. No credit card required.